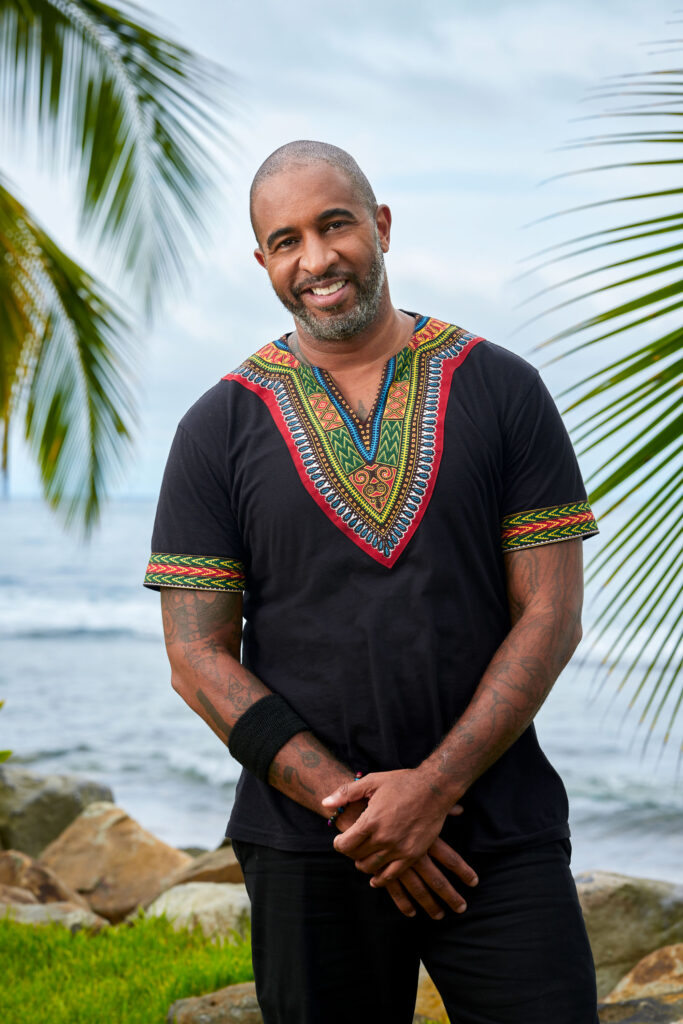

A couple weeks ago, I had the amazing opportunity to speak to Yuong Lam, the Chief Operations Officer of CBD Farmhouse. This was a great conversation and made me more curious into the current situation behind CBD regulation and adaptations to the current pandemic. I reached out throughout Texas and found a CBD organization that would have an interesting view. I had the privilege to have a conversation with Whitney Jaynes, the president of Hemp Lyfe, which delivers CBD products with high potency and bioavailability to guarantee an enhanced lifestyle.

BDSA research found that dispensary sales of CBD were up across all major legal markets. Dispensary dollar sales of CBD-infused edibles were up 73% versus last year and CBD-infused beverages were up 55%, but CBD supplements didn’t have the same spike. Why do you think edibles and beverages had a bigger sales spike during this pandemic and what has been the top COVID-19 products in your store’s inventory?

My theory on why I believe sales were up with those particular products, is that edibles are one of the most popular types of products in the cannabis space. In fact, at the end of last year I saw a study mentioning CBD edibles were the #1 google searched product when it comes to CBD. I also have noticed a common familiarity around edibles or CBD gummies to be specific and so when people think of CBD, or trying it for the first time, there is a bit of an attractive and “trendy” interest in going for a gummy vs a supplement and I believe the same can be said for the beverages. CBD beverages are a new product category so there is an interest peaked behind it. I have found that people aren’t always necessarily looking for better, they are looking for different…and CBD beverages and edibles are different. We always see an interest when it comes to our CBD gummies and they are a top seller, but a top product we have been seeing a spike in during COVID-19 is our Dream CBD Soft gels! This product is specifically for rest and recovery and being that sleep and recovery is so important for our immune system, mood, and overall health, lots of our customers have found the importance of quality sleep and how our Dream product has helped tremendously during these overwhelming times.

According to the 2020 CBD Market Report, middle-class households (making $40,000 to $75,000) now account for nearly one-third of CBD consumers. This new demographic has stated that price is the second ranking product attribute that they consider. Has your business needed to develop new strategies to handle a price sensitive crowd and do you foresee any other changes with an increasing middle-class customer base?

While that age bracket may be growing in the consumption of CBD, the price of CBD is still staying very strong. I do not see this demographic effecting the price of CBD. CBD does lean more to being a luxury product, and it carries a luxury price. You get what you pay for in this space and If you are paying a very cheap price, most likely you are getting a cheaply made product and possibly even some snake oil. What we have seen happen is the consumer buys the cheaper product, but always comes back to the higher priced one because the cheaper one did not give the effects and benefits that the more expensive one did. I only see prices staying strong and we pride ourselves in quality ingredients that are third-party tested for our customers and we believe integrity is more important than a price point so it just isn’t an area we believe we should budge in! We also are always offering specials, promotions and deals around a variety of holidays so for those that may be in a price sensitive crowd, we encourage to join our newsletter and to invest in your health when possible!

The Controlled Substance Act has rippling effects on cannabis organizations, where a cannabis-related business has limited opportunities to deduct business expenses from their taxes. The 2018 Farm Bill essentially removed CBD from this act, which makes it federally legal. Are there any additional regulations or public perception that has had negative effects on CBD businesses?

I think a common public perception that we run into is that CBD will get you high, or the idea that it is the same as Marijuana. We do a lot of educating and differentiating to our consumers on this topic but I think the fact that the FDA and other governing entities have only just recently approved of selling CBD, it still an area that some people are skeptical of. But that will get better with education and normalizing it more. As for regulations, there are a few that have really been difficult for CBD businesses but primarily ones that have to do with making any claims, describing the product and it’s benefits, and marketing the products. Most marketing platforms don’t allow you to use the word CBD much less even have it on your product labels in a photo without it being flagged, so advertising and getting the word out digitally can be very difficult. The FDA is still putting the hammer on a lot of companies for making any sort of health claims and we are hoping this lightens up in the future so we can spread the good news about what CBD does and how it can help!

Some critics are worried that federal legalization of cannabis could send cash-strapped dispensaries into the arms of alcohol, soft drink, and tobacco giants. Canada-based Canopy Growth Corporation have also stated their intentions in selling drinks containing THC next year to compete with beer, rivaling Anheuser-Busch InBev AB, which controls 42% of the North American beer market. Do you hold a positive or negative outlook on new corporations diving into legalized cannabis?

I am open to it, as I can see some positive benefits that can come from it if companies like ours, if built properly, will be bought in by companies you mentioned. I see that as the evolution of business and the “American Dream” there will always be plenty of space for great companies big or small and as the consumer market will continue to grow at rapid rates! I think that is what is so special about being an entrepreneur in America.

NeuroXPF, a CBD company based in Nevada, have stated that their products prevent COVID-19 by boosting the user’s immune system. The FDA and FTC issued a joint warning letter asserting that the claims are unsubstantiated, which violates the Federal Trade Commission Act. Do you see any concerns in supply lines, potential contamination of products, or any other logistical issues?

Just like the vitamin industry, we have to follow the laws and label regulations in addition to any medical claims. As far as seeing any contamination and bad products coming down the supply chain, it absolutely occurs. What we have seen lately is the business owners and brand owners are getting smarter and know how to identify these issues and more importantly they are and have put measures in place to help prevent these types of issues arising. Also, brand owners are getting smart in learning how to recognize and ask for the right type of paperwork from the suppliers to see if the supply chain is in compliant federal and safety guidelines. I think it is getting better, as it should be!